As the cryptocurrency world grapples with the dual forces of innovation and regulation, Circle’s recent announcement of the termination of the USDC token support on the Tron blockchain underscores the complex interplay between advancing technology and adhering to regulatory standards.

The Announcement and Its Implications

In a move that has sent ripples through the cryptocurrency community, Circle, a major player in the U.S. crypto market, announced its decision to terminate support for its USDC token on the Tron blockchain.

This decision, effective immediately, halts the minting of new USDC tokens on Tron, a platform that has gained popularity for its fast and efficient stablecoin transactions. Circle, headquartered in Boston, emphasized that this step is in line with its commitment to maintaining USDC as a trusted, transparent, and safe currency.

With USDC being the second-largest stablecoin by market cap, trailing only behind Tether (USDT), and with $335 million of its value hosted on Tron, this move marks a significant shift in the stablecoin ecosystem.

Background and Context

Circle’s decision comes against the backdrop of regulatory scrutiny faced by Tron’s founder, Justin Sun, in the United States. Last year, Circle also terminated accounts associated with Sun and his companies following lawsuits from the Securities and Exchange Commission (SEC) accusing Sun of manipulating trading volumes and selling unregistered securities. This context of legal challenges and compliance issues appears to have influenced Circle’s strategic reassessment of its blockchain partnerships.

Despite not citing specific reasons for ending support on Tron, Circle has made it clear that it continuously evaluates the suitability of blockchains under its risk management framework. The company has laid out plans for a phased withdrawal of USDC from Tron, advising both retail and institutional clients on how to transfer their holdings to other blockchains or redeem them for traditional currency, with a final deadline set for February 2025.

Visit our main page to exchange USDC on Tron for other networks, or sell it for cash.

The Shift to Solana and the Future of Stablecoins

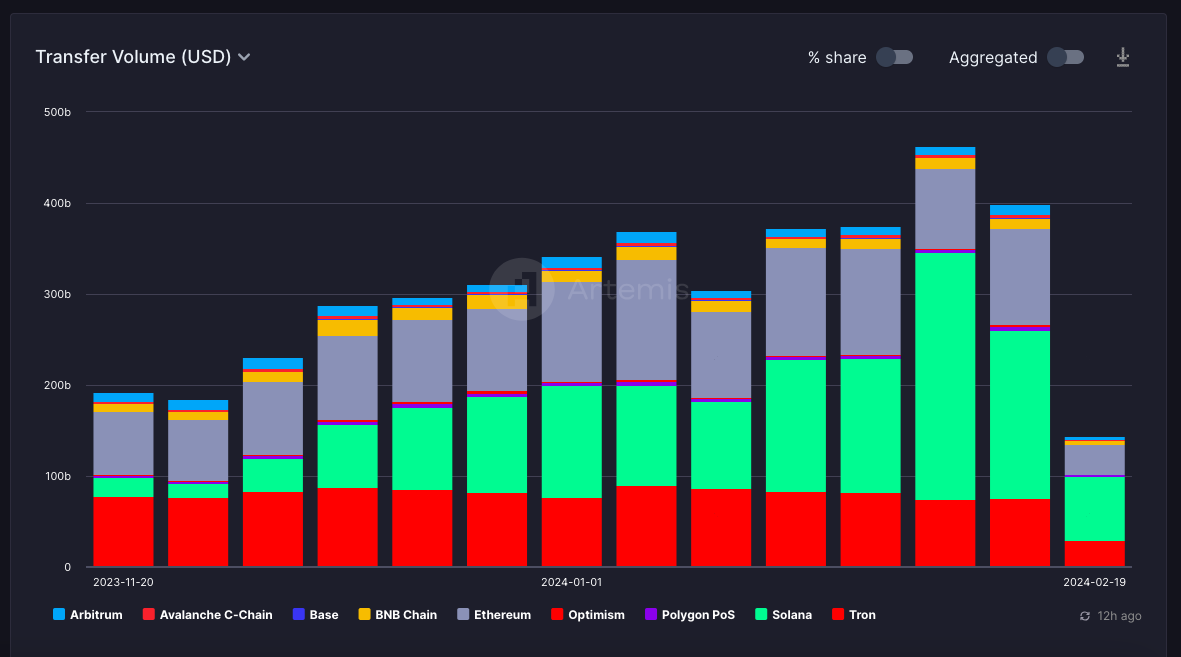

This development coincides with a notable shift in the stablecoin landscape, where Solana has emerged as a new favorite for USDC transactions, overtaking Tron in popularity. In the past six months, Solana has facilitated over 80% of USDC transactions, highlighting its growing dominance in the stablecoin space. This surge in activity is a testament to Solana’s technical capabilities, but except that, it signals a broader trend of diversification within the stablecoin market.

Solana has seen a significant increase in stablecoin transfer volume over the past few months. Screenshot: Artemis.

Moreover, the introduction of new stablecoins on Solana, such as Paxos’s USDP, further cements the blockchain’s position as a leading platform for stablecoin activity. However, it’s important to note that despite these shifts, Tron remains a significant player in the stablecoin arena, particularly for USDT, which still boasts over $50 billion in circulation on the platform.

Market Dynamics and the Continued Role of Tron

While Circle’s withdrawal from Tron might seem like a setback for the blockchain, it’s crucial to recognize that Tron continues to hold a substantial portion of the stablecoin market, especially with USDT. The dynamics between USDC and USDT illustrate the competitive yet complementary nature of the stablecoin ecosystem, where multiple platforms and tokens coexist, catering to diverse user needs and preferences.

In conclusion, Circle’s decision to end USDC support on Tron underscores the evolving nature of the cryptocurrency landscape, where regulatory, technical, and market factors continuously shape the strategies of major players. As the stablecoin market matures, the focus on compliance, transparency, and user safety becomes increasingly paramount, guiding the decisions of firms like Circle. Meanwhile, the rise of Solana as a preferred chain for stablecoin transactions signals a shift in the balance of power, suggesting that the future of stablecoins may lie in the ability of blockchains to adapt, innovate, and foster trust among users.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.